Case StudyHow a top-rated learning initiative "brewed up" business and financial acumen at a craft beer pioneer

Over 150 employees, managers and executives of a craft beer company went through our Business Acumen Accelerator. The initiative targeted people across a wide range of functions: finance, marketing, legal, human resources, supply chain, productions and sales. The learning initiative developed the business competencies of finance, strategy and decision-making.

Executive Summary

Financially Fierce was highly effective at helping the craft beer employees overcome their fear of finance and getting them more involved in the budgeting process. We also improved communication throughout the company. Surveys showed wide-ranging benefits took hold at the company. These are in the form of better pricing, shorter meetings, stronger inventory management, more attention to cash flow, and improved budgeting.

Survey Method

In cooperation with the craft beer company, all 186 participants were sent surveys immediately before, during and after participating in the business acumen accelerator. The surveys contained open response questions and scale questions with open response range from 1 (not comfortable) to 5 (very comfortable). From this data we were able to gain insight into the benefits of the initiative.

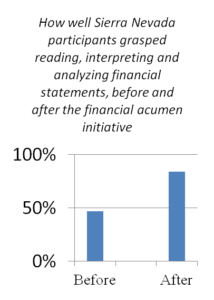

Data from the pre- and post-initiative surveys showed a significant increase in all measured areas of business and financial acumen for participants.

Overcoming Fear of Finance

Not everyone is afraid of finance; some people just don’t like looking at a report that includes finance numbers.

Whatever the reason, the result is the same: although they are involved in the budget process, they are not fully engaged – they won’t provide accurate information, won’t manage the budget, and won’t make decisions that benefit the company.

Financially Fierce is making life easier and more efficient at the craft beer company by overcoming fear of finance and giving people the tools they need to work effectively with numbers – and each other.

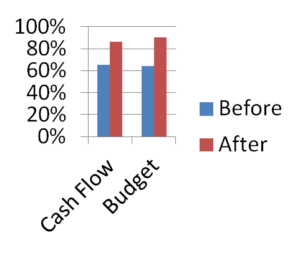

Cash Flow & Budgeting

All employees impact the business. Shouldn’t they all understand how it works?

Surveys before the initiative showed that only 65% of the non-finance employees realized that their position had an impact on cash flow at the company. Similarly, 64% were comfortable with being involved in the budget process. During the initiative, participants experienced the benefits of using financial tools and were able to see how their decisions impacted company performance. The result? After the initiative ended, 85% of the participants said their jobs had an impact on cash flow and a full 90% of the participants felt comfortable with the budgeting process!

After the initiative, 90% of the participants felt comfortable with the budgeting process!

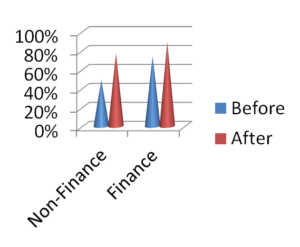

Improved Communications

Comfortable talking with members of the Finance Dept.

Good communication happens when everyone approaches a subject from a shared place of understanding.

We say ‘finance is the language of business’. When everyone ‘speaks finance’ they can better communicate with the Finance Department and each other. Meetings are faster, the budget process speeds up, information flows more rapidly (and more accurately), and everyone makes better decisions.

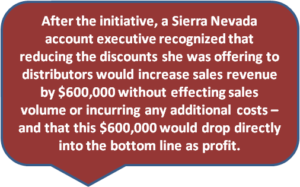

Quantifying ROI

It is challenging to quantify ROI for business acumen initiatives because the effect of better business acumen is widespread. People may not even realize that they are making better decisions.

However, a survey of the employees provided proof that the initiative was driving behavior change that directly improved the company’s bottom line.

And since a lot of managers don’t like to say that they are doing something better as a result of an initiative (because it implies they were doing something wrong before), for every one situation that was identified there are likely dozens more that were not reported.

"We were able to generate an additional $600k (profit)."

Financially Fierce is driving ROI across the Company

Direct return on investment through improved sales is just one way in which Financially Fierce improved the bottom line at the craft beer company. Participants also reported actions that drive ROI in the following ways:

Sales people responded to finance requests quickly and with accurate data as they now understand why they were being asked for the information:

“I have been better able to communicate our goals to my distributor and the reasoning behind them.”

——————–

Production is more careful managing working capital because they now understand the cash flow implications:

“I worked to reduce wasted inventory thereby saving $274,000/yr.”

Buyers are more savvy negotiators and ask for longer payments terms because they recognized the value difference between paying now and paying later:

“Employees now understand the financial impact of paying vendors sooner than 60 days. They are now reviewing payment terms before accepting proposals.”

——————–

Communication has improved too:

“I feel more comfortable in discussions with Finance. I have a clearer understanding of the impact of inventory, accounts receivable and accounts payable on the business.”

“I am able to communicate financial results to my team and answer any questions they may have.”